Technological advancement to enhance cruise ports

By Fritz Pinnock and Ibrahim Ajagunna

2018, November 1: Cruise tourism continues to be a supply-led industry in that demands increases as more cruise ships are built. On the other hand, the rest of the transportation industry, including the ferry services, remains a derived demand and demonstrates the fluctuations of the market.

Since the birth of modern cruise tourism in the late 1960s, the industry has been increasing each year and has not been affected in any significant way by market forces, as the industry remained agile and shifts its assets to weather the storms.

The crisis of 911 in US presented a shift where the cruise lines opened up new North American homeports along the southern coast of the country, so as to eliminate the need for passengers to fly to join vessels. Numbers increased while other segments of the tourism industry virtually collapsed.

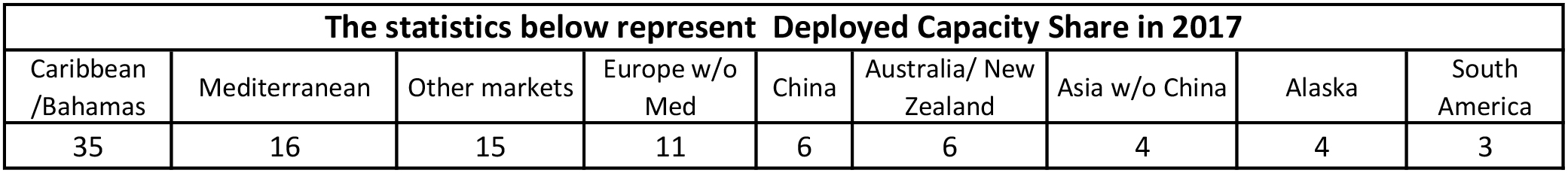

While this is so, the cruise industry continues to grow by becoming more global in both itineraries and passenger sourcing. Meanwhile, the Caribbean continues to take market share at a decreasing rate. This is partly attributed to an inability to respond to the technological and global shift of the cruise industry.

Interestingly, in mid-2000, the Caribbean accounted for approximately 50% of market share. This has declined to just over 35% while new regions such as China, Pacific, New Zealand and Australia are showing significant signs of growth. The smaller ships have been moved out moved out in the search for ‘untapped’ and ‘exotic’ areas of the world. And they are being replaced by megaships with the capacity to carry more passengers with fewer vessel calls. Alongside this reality is the phenomenon in which cruise lines, owning private islands (with the Bahamas accounting for the largest number), control much of the destination earnings.

The Caribbean region has been investing heavily in cruise port facilities. The hope is to attract larger vessels. But the economic impact has been less than some may have anticipated. The reasons may address issues related to realities, such as:

- Cruise lines have been innovators, while the Caribbean destinations have been counting passenger numbers (as opposed to reinventing the product).

- New ports are limited to what can be done with the facilities outside of the winter cruise season, while faced with high capital cost (a burden on the tax payers).

- Duty-free shops carry extremely high overheads and a short operating season.

- Cruise ports are not built with the crew in mind. Labadee Haiti, which is RCCL’s private island, has special crew facilities ashore.

- New cruise ports that accommodate the mega cruise ships, such as Falmouth.

- Jamaica and St. Maarten, have limited amenities for the ships themselves, including bunkering and garbage disposal.

- There are limited investment in new and exciting attractions ashore to match the increase in the numbers of cruise passengers.

- The management of the time ashore to ports that offer the cruise ships the best returns, including more days at sea. In private islands all earnings go to vessels.

- Compulsory tips are now taken from guests’ credit cards are now a part of the hotel staff salary while spa and other specialty areas of the vessels are paid by commissions.

- The hotel staff work, on average, seven-month contracts with two to three months off and are drawn from across the world.

There is an inverse relationship between the size of the cruise ship and net earnings to the Caribbean economies in that, as the ships get larger, the higher the ‘leakage’ back to the vessels as the ships themselves become a destination1. The Oasis Class ships are now full-fledged floating resorts that boast Central Park, zip lines, large shopping malls and endless onboard entertainment. In a recent interview, several passengers on RCCL vessels said they did not come off the vessels, as everything ashore was better onboard and not as hot and humid in August.

According to the FCCA’s statistics, 27.2 million passengers globally cruise the oceans. This included an increase of 10% over 2016. The degree of success is endless for the cruise line with the introduction of nine new mega vessels and 32,000 lower berths at an investment of 7.4 billion USD. In addition, between 2018 and 2025, 51 new vessels on order will to be delivered. This will represent 220,000 lower berths at an investment of 51 billion USD with an average of 4,000 passengers per vessel.

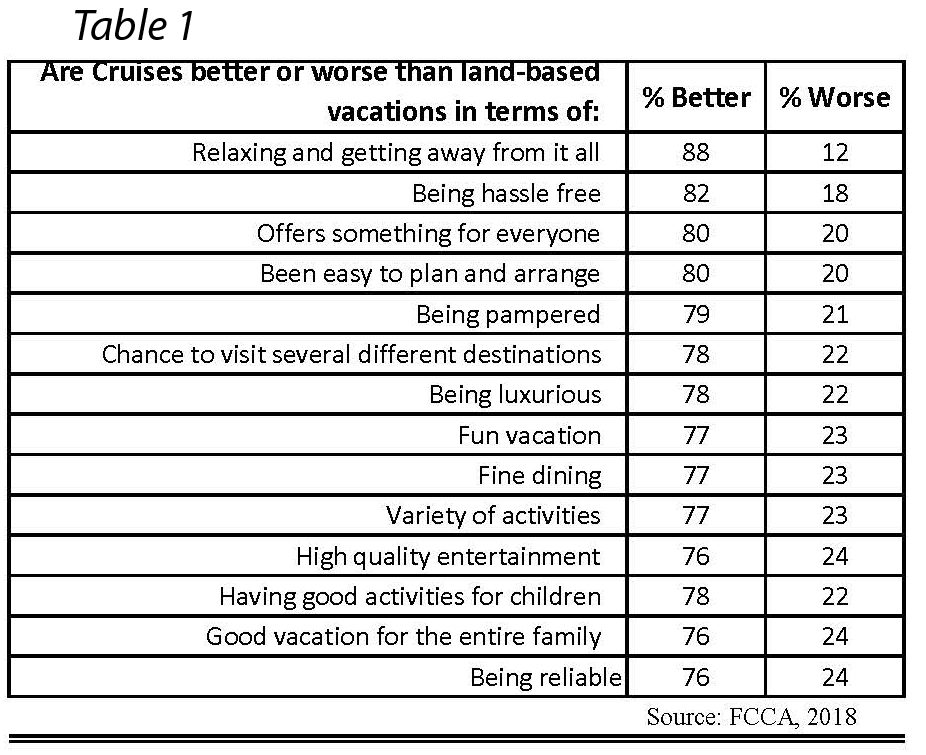

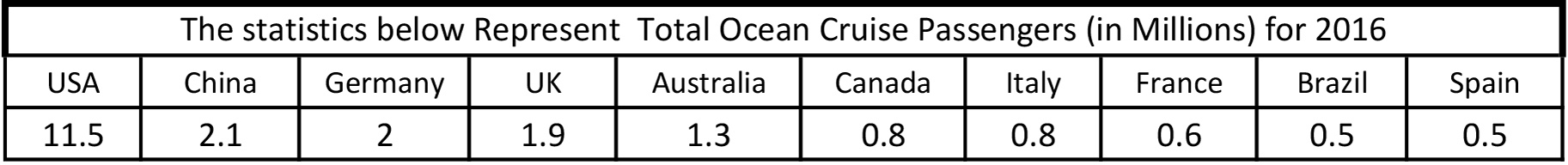

The statistics in the attached tables show the position of the industry in recent time.

Whereas the numbers for the USA are increasing, the rise of new destinations such as China, the Pacific and South America are also rising (but at a faster rate), thereby decreasing the overall US market share. Similarly, while the deployment for the Caribbean cruise passengers numbers have been increasing, fewer ships carrying passengers to new destinations growing at a faster rate and the Caribbean overall market is ‘tending south’, as indicated in the tables below.

Trends in 2018

Cruise Critic predicted that 2018 promised to be one of the biggest years in cruising. The prediction focuses on trends that will further shape the industry going forward. These include: technology that augments the cruise experience, cruises focusing on specific countries, bigger ships getting better, destination port renovations to improve cruise terminals and expedite embarkation and innovation as cruise lines look to rivers and land for inspiration. In addition, yachting continues to gain traction while river cruising gets more active and cruise lines continue to invest more and more in private islands.

It is obvious that the cruise product is changing to an experiential product. Passengers are demanding service from authentic Caribbean nationals who make up less than 7% of overall crew deployment despite the region’s one-third global market share.

When compared to the low salaries and seasonality affecting the land-based hotel industry, cruise tourism jobs are now more attractive to nationals from Jamaica, Saint Lucia and from St. Vincent and the Grenadines, to name a few.

Every Caribbean cruise port must continue to ‘reinvent’ itself and in so doing acquire the technology that support modern day cruise ships. While the cruise lines are aggressive in reinventing the vessels and acquiring private islands, Caribbean cruise destinations are lagging. At this rate, as the ships get bigger and more attractive and private islands become more fun, some cruises may not include a port call and may be completed without actually entering a Caribbean cruise port.

The authors are predicting that this will become a new wave of cruising where, between the days at sea and time on private islands, the cruise line will be able to keep 100% of the feast (earnings) while countries that depend on the cruise ship industry compete for the crumbs. []

1. Pinnock & Ajagunna (2011)