Caribbean Development Bank investing in infrastructure

… in better position to mobilise special climate finance resources

[First published in Portside Caribbean magazine March 1, 2017]

The end of 2016 saw the Caribbean, like much of the world, affected by the low economic growth which has characterised the performance of most of the Caribbean Development Bank’s (CDB) Borrowing Member Countries since the onset of the 2007-2009 global financial crisis.

In its World Economic Outlook, published in October 2016, the International Monetary Fund (IMF) projected global economic growth of 3.1% for 2016 and a slight improvement to 3.4% for 2017.

The corresponding projections for the Bank’s Borrowing Member Countries are below global projections, with some exceptions. With 2016 growth projections lower than the GDP growth recorded in 2015; and, with only marginal improvements projected for 2017, there is a lot of work to be done in order to maintain and improve the livelihoods of Caribbean populations.

In 2017, the CDB will be mid-way through implementation of its 2015-2019 Strategic Plan. Strengthening and modernising economic and social infrastructure is one of the Bank’s main corporate priorities under its strategic objective of supporting inclusive and sustainable growth and development. It is well accepted that sound infrastructure is a key part of the enabling environment for positive economic performance. Poor infrastructure is an obstacle to economic activity and therefore hinders the achievement of increased employment opportunities and reduced inequality.

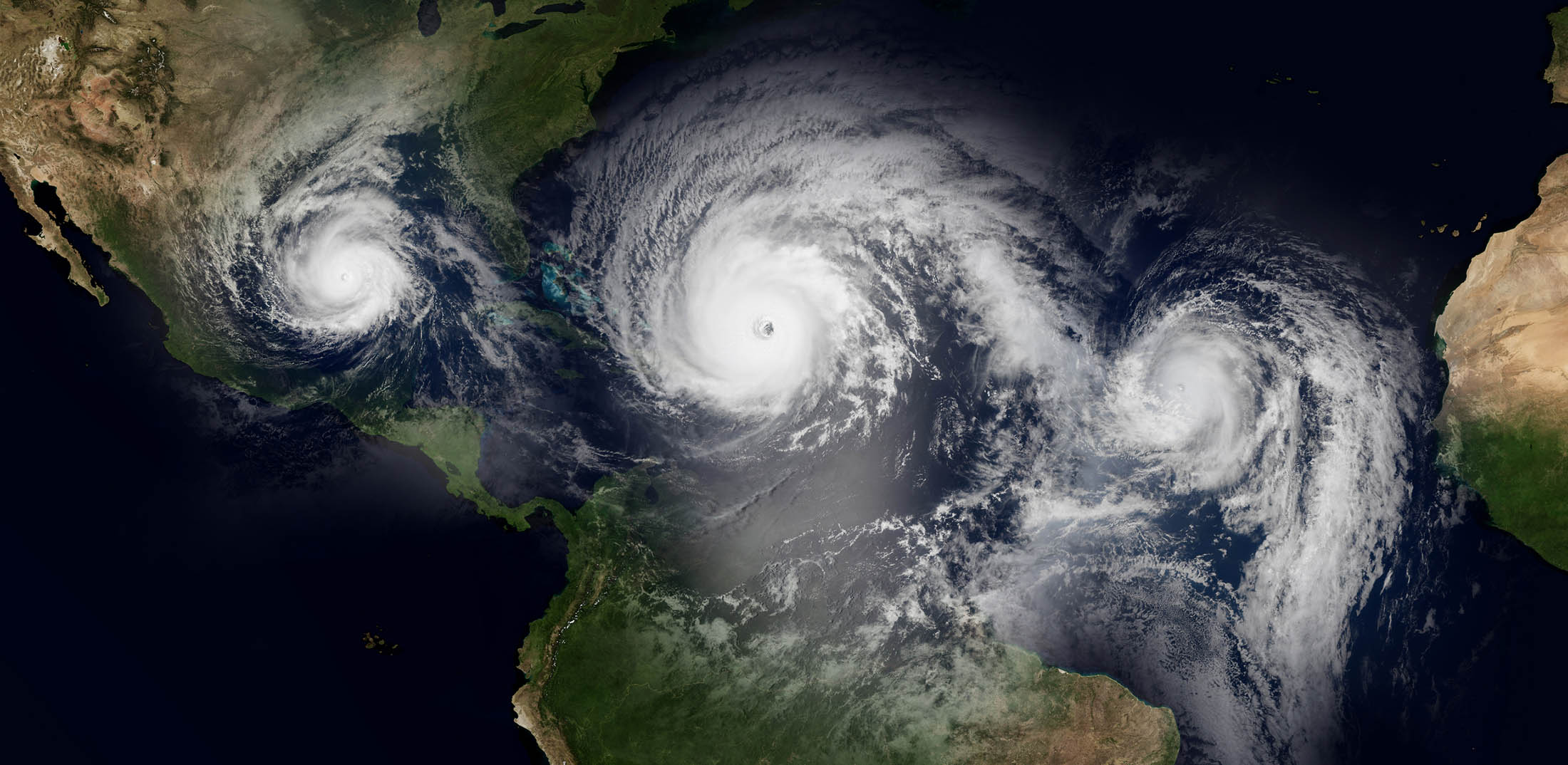

Much of the infrastructure in the Caribbean is highly exposed to extreme weather and climate risks. Increasing temperatures, rising sea levels and intense extreme rainfall events – from storms and hurricanes – pose particular risks in low-lying, flood-prone coastal areas and locations susceptible to landslides. Risks include damage to residential and commercial buildings, roads and other transport infrastructure, power generation facilities and transmission/ distribution structures, as well as water supply systems.

Much of the infrastructure in the Caribbean is highly exposed to extreme weather and climate risks. Increasing temperatures, rising sea levels and intense extreme rainfall events – from storms and hurricanes – pose particular risks in low-lying, flood-prone coastal areas and locations susceptible to landslides. Risks include damage to residential and commercial buildings, roads and other transport infrastructure, power generation facilities and transmission/ distribution structures, as well as water supply systems.

As has been typical for most years in recent memory, 2016 again saw the Bank’s Borrowing Member Countries affected by several climate-related events and natural disasters. Hundreds of lives were lost in Haiti due to the impact of Hurricane Matthew. The 2016 events were also costly in terms of damage to infrastructure and disruption to services. Transport infrastructure has been among the most heavily damaged assets due to flooding and extreme rainfall events in recent years. Some of the main challenges in this regard include:

- The onerous debt management and fiscal constraints facing many Borrowing Member Countries;

- Inadequate asset management systems, with a low priority placed on maintenance;

- Inadequate design standards in many Borrowing Member Countries, including outdated climate information; and,

- The limited human resource capacity in the agencies responsible for the provision and management of transport infrastructure.

Since 2013, CDB has integrated climate vulnerability and risk assessments into the development of its physical infrastructure projects and has dedicated substantial resources towards enhancing climate resilience in its Borrowing Member Countries. This year finds the CDB in a better position than it has ever been to mobilise special climate finance resources to help Borrowing Member Countries better adapt to impacts from climate variability and climate change.

Adaptation Fund

In February 2016, CDB was accredited as a Regional Implementing Entity of the Adaptation Fund (AF). The Fund was established to finance concrete or tangible climate change adaptation projects that reduce the adverse effects of climate change facing communities, countries, and sectors. Projects financed through the Adaptation Fund are expected to be scalable and to be replicated if proven successful. The Adaptation Fund provides funding up to USD10 million per project. Adaptation projects can be implemented at the community, national, and transboundary level. AF-funded projects must demonstrate:

- vulnerability to climate risk;

- the level of urgency and risk arising from delay;

- adaptive capacity to the adverse effects to climate change;

- regional co-benefits, to the extent possible; and

- the maximum achievable multi-sectoral or cross-sectoral benefits.

Green Climate Fund

The CDB became accredited to the Green Climate Fund (GCF) in October 2016. Green Climate Fund finances both adaptation and mitigation projects and programmes. These projects must be transformational; demonstrate the potential to catalyse impacts beyond a one-off investment; and, contribute to the achievement of the Fund’s objectives and result areas.

The CDB, on behalf of a Borrowing Member Country, can access USD10 million to USD50 million per project (micro and small) from the Green Climate Fund. Projects can utilise a range of instruments, including concessional loans and grants and can be blended with CDB’s other resources or with streams of financing from other development partners and institutions, accredited and otherwise.

The CDB has the capacity to assist countries in designing and submitting viable proposals in keeping with the investment criteria and results frameworks of Adaptation Fund and Green Climate Fund and oversee the management and implementation of approved projects and programmes.

Climate Action Line of Credit (CALC)

Since 2014, the CDB has utilised resources accessed from the European Investment Bank to provide concessionary financing for capital works on social and economic infrastructure projects across several Borrowing Member Countries. Approved projects addressed renewable energy and energy efficiency projects; adaptation projects in the transport, water and wastewater sectors; and, climate risk and vulnerability assessments to facilitate infrastructure development and enhancement to the climate resilience of several sectors.

EU-ACP-CDB- Natural Disaster Risk Management

In addition to mobilising financial resources for infrastructure development, 2017 will see the Bank engaged in several related knowledge-building activities. Through partnership with the European Union, under the African Caribbean Pacific – European Union – CDB Natural Disaster Risk Management Programme, the CDB will review and adapt risk and resilience decision-making standards and approaches pertaining to the road transport and the water and sanitation sectors. Toolkits will be developed for use across Borrowing Member Countries to help mainstream climate resilience in these two sectors. Knowledge about application of these resources will be disseminated electronically and through workshops.

Communities of Practice will be developed around climate change adaptation and resilience to natural hazards affecting these sectors, with participation from development partners and regional institutions.

Special Development Fund (Unified)

Special Development Fund (Unified)

These concessional financing resources will also be used, in part, to improve the resilience and environmental sustainability of the Borrowing Member Countries, helping to mainstream environment, disaster risk and climate resilience into planning national investment programmes. The CDB will also assist regional institutions to improve knowledge and information systems to support similar objectives. Initiatives are expected to include support for improved spatial data capacity for disaster risk management and climate change adaptation; climate risk and vulnerability assessments and development of climate adaptation plans.

UK Caribbean Infrastructure Partnership Fund (UKCIF)

Last year (2016) the CDB, through its partnership with the UK Department for International Development (DfID), approved the first technical assistance and capital works projects under the UK Caribbean Infrastructure Partnership Fund. This Fund will support projects in nine eligible Borrowing Member Countries. Projects must be transformational in nature and provide critical infrastructure which will drive growth, reduce poverty and increase resilience to climate change. Most of the technical assistance for the preparation of capital works to be financed by the UK Caribbean Infrastructure Partnership Fund will be undertaken during 2017.

The transport sector has been the single largest recipient of CDB assistance to date. Efficient air, maritime and inland waterway connections (within and between Borrowing Member Countries; and, with other trading partners) are essential for trade facilitation and integration with global value chains. Furthermore, access to employment opportunities and education, health and other services and obtaining benefits from those services hinge on the availability of safe, efficient and inclusive transport systems. In 2017, the Bank will undertake a comprehensive assessment of the transport sector across its Borrowing Member Countries. It will be developing data, analyses and recommendations that will enhance the capacity of the Bank and Borrowing Member Countries to contribute to sustainable development through prioritised interventions in the transport sector. Concurrently, through an assessment of the urban development sector, the CDB will mobilise the potential of the urban sector to contribute to the sustainable development of Borrowing Member Countries. The Bank will also continue to build on the Assessment of the Water Sector in the Caribbean which was completed in 2015.

High on the CDB’s agenda, in parallel with support for the construction and rehabilitation of physical infrastructure, are measures to reform and strengthen the frameworks and institutions required for the efficient and effective use of infrastructure. Together with the Bank’s new Public Policy Analysis and Management and Project Cycle Management Training Programme, the Regional Public Private Partnership (PPP) Support Facility[1] is expected to play an increasing role in broadening the range of approaches and enhancing the competencies at the disposal of the Bank’s Borrowing Member Countries for leveraging their investments in infrastructure to achieve sustainable development objectives.

Cross-cutting all interventions is the Bank’s mandate of poverty reduction. Inclusionary approaches that integrate all stakeholders into the design and implementation of projects, including vulnerable population groups such as the poor, the youth, or persons with disabilities, is key to ensuring the success of public investment projects. Enhancing gender equality is a further underpinning principle. Measures to build resilience go hand in hand with steps to ensure inclusion. The year ahead will be full of opportunities for CDB and its Borrowing Member Countries to take advantage of these exciting channels of development assistance, powered by the exceptional commitment of the Bank’s staff to the development of the Caribbean. []

[1] The Regional Public Private Partnership (PPP) Support Facility was established at CDB in collaboration the World Bank, the Inter-American Development Bank, Multilateral Investment Fund, and the Public Private Infrastructure Advisory Facility.